Stripe setup

Payments | Stripe

Stripe is a popular payment gateway that offers several benefits over other payment gateways. Here are some reasons why you might choose to use Stripe over other options:

- User-friendly: Stripe has a user-friendly interface that makes it easy to set up, manage, and use. It also provides a range of integrations with popular e-commerce platforms, making it simple to integrate into your website or app.

- Global coverage: Stripe supports payments in over 135 currencies and is available in more than 40 countries, making it a great choice for businesses with a global customer base.

- Advanced security: Stripe uses advanced security measures to protect sensitive payment information and prevent fraud. It is PCI compliant, meaning it meets the industry standards for payment security.

- Customizable: Stripe provides a range of customization options, allowing you to tailor the payment experience to meet the unique needs of your business. This can include custom forms, payment pages, and checkout flows.

- Flexible pricing: Stripe offers flexible pricing options, with transparent fees that are easy to understand. This makes it a great choice for businesses of all sizes, as it allows you to scale your payment processing as your business grows.

- Reliable: Stripe has a proven track record of reliability and is used by many large and well-known businesses, making it a trusted choice for your payment processing needs.

- Good customer support: Stripe offers excellent customer support, with a range of resources and support options to help you get the most out of the platform. This can include online documentation, email support, and live chat.

In conclusion, Stripe is a great choice for businesses looking for a reliable and flexible payment gateway. With its user-friendly interface, global coverage, advanced security, customizable options, flexible pricing, proven reliability, and good customer support, Stripe offers a range of benefits over other payment gateways.

Before being able to accept credit cards and recurring payments on your mition site, you will first need to add a payment gateway, currently we offer Stripe as the simplest method to receive money from your customers/members.

You can also accept payments manually and record payments manually such as bank transfer, cash and cheque.

The easiest way to automate collecting money is to use credit cards and to add a Stripe account. It is up to each organisation to create their own stripe account and the relationship between your organisation and stripe and any fees they charge.

You can add an existing stripe account or you can create a stripe account in a day! Follow this link to start a new stripe account.

https://stripe.com/en-au

Note: As of April 2025, the TEST mode is now no longer a toggle switch, it is in the URL /test. So to find the API keys for TEST, you can go to:

https://dashboard.stripe.com/test/apikeys

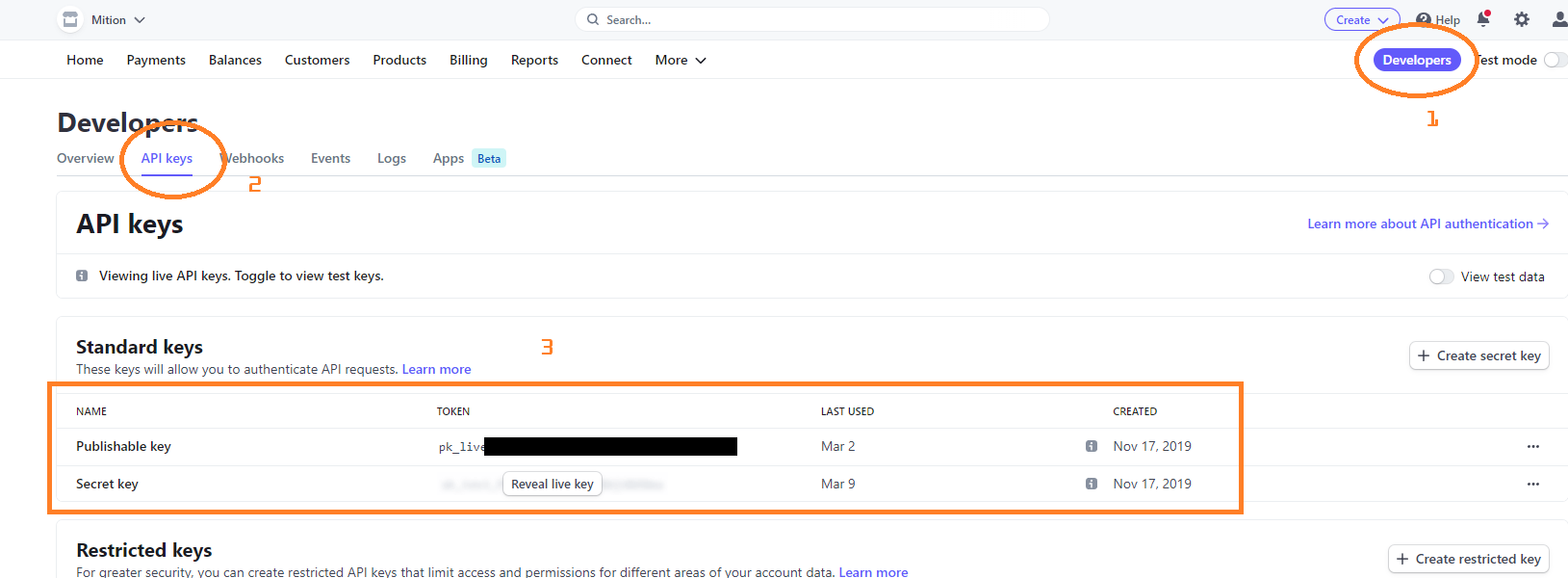

Adding your stripe keys.

There are two keys, a perishable key and a secret key, above is an image as to how to find your stripe keys. Click on Developer, then API Settings.

Example Perishable Key (note that the production one starts with pk_live....)

pk_live_51KIj**********************************

Secret Key (note that the production one starts with sk_live...)

sk_test_51KIj**********************************

Add these to the Admin Settings of your mition site. Under

Admin Setting > Payment Gateway > Stripe Public Key (place the perishable key in this textbox)

and

Admin Setting > Payment Gateway > Stripe Secret Key (place the secret key in this textbox)

What Happens Next?

At this stage, we are only using the Production Stripe system, but we have the ability to test in the Developer Stripe system should we need to debug or run tests in the future.

Stripe will take their fee and pay the remainder into the bank account you have added to your Stripe account.

(rates correct as at July 2025)

Stripe domestic card processing fees are currently set at: 1.70% + A$0.30 for online payments.

Using the updated fee structure, here's the breakdown for a $1.00 transaction:

- Fee Amount: A$0.017 (1.70% of A$1.00) + A$0.30 = A$0.317

- Final Amount: A$1.00 - A$0.317 = A$0.683

The final amount transferred to the bank account would be A$0.683.

With Stripe’s current fee structure in Australia (1.70% + A$0.30), here is the breakdown for a $15.00 membership fee:

- Original Amount: A$15.00

- Fee Amount: A$0.255 (1.70% of A$15.00) + A$0.30 = A$0.555

- Final Amount: A$15.00 - A$0.555 = A$14.445

Stripe also combines multiple payments and makes a single transfer, so if 100 members pay at once, Stripe only sends one bulk payment.

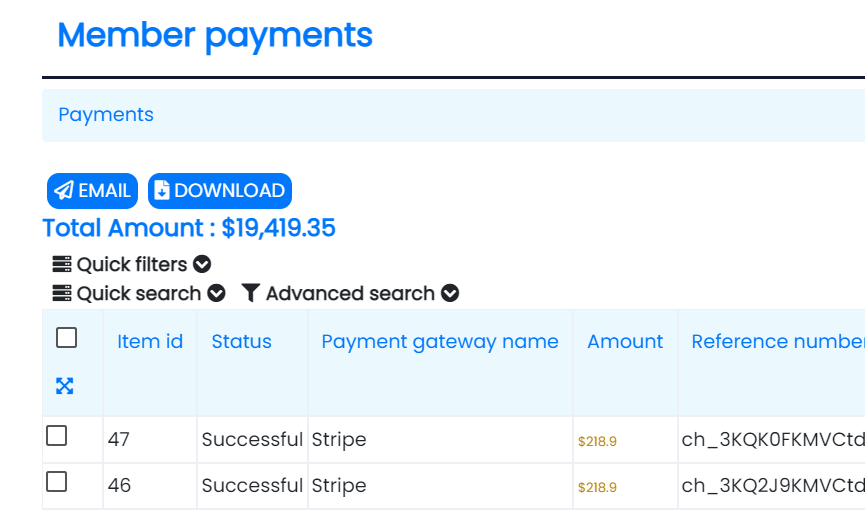

The payment information and invoice details can be found in Mition. The attached invoice and two CSV files were downloaded from the invoice and payment screen in Mition; you can also access similar details from Stripe.

Mition does not take any fees; the relationship your organisation has with Stripe is between your organisation and Stripe. Mition simply facilitates the two systems communicating with each other.

Note: International cards have higher fees. If you foresee your clients having overseas credit cards, please read more about Stripe pricing here.

Mition has General Ledger codes and you can check which ones include GST and which ones do not. You can adjust the GST % in Admin Settings > Invoicing > GST The webpage component for Subscriptions lists your publicly available subscriptions, but it by default shows the values pre-GST. If you want to show the amount after GST you need to go into Admin Settings > Invoicing and check OR uncheck the setting called Show all pricing EX GST

Currency String

By default the currency displays as "AU", if your stripe account is not in Australian dollars you should change this to the currency that matches your stripe account. You can change this under Admin Settings > Invoice > Currency String.

For iOS Apps to be approved for the Apple Store, Apple Pay must be setup in Stripe. The alternative is to hide anything to do with subscriptions and payments from the Apps (which is not ideal). To setup Apple Pay, it is straight forward and our team will help you configure Stripe and add a merchant certificate for you that verifies your Apple Pay account. There is also domain configuration and this needs to match the Domains listed in Stripe.

see instructions

https://www.mition.com/api/WebsiteCached/DownloadFile?FileGuid=cbd146b4-9d03-415b-b086-ac95e2acf8ad#EXT=.pdf

For Android Apps to be approved for the Google Store, A merchant ID must be for each customer. The alternative is to hide anything to do with subscriptions and payments from the Apps (which is not ideal). To setup a Google Merchant ID head to https://pay.google.com/business/console, setup a business account. It is straight forward and our team will help you if you get stuck. You will find that approval for the Merchant ID is straight forward but approval for Google Pay API is more difficult, with screenshots of your APP required and the turnaround for approval seems to be over a week. There is also domain configuration and this needs to match the Domains listed in Stripe.

Give users a 6 digit code over the phone or use PaID for a 1 click payment solution that works with Stripe. Users are not required to login, instead we provide a unique code per user, this remains constant throughout the lifetime of each user. This code will fetch the users lastname and the amount owing and present a STRIPE payment form. To get users to enter the 6 digit code [WebsiteURL]/paid Use in automated emails. Use this link in an Invoice email and it create the unique link for each client using their unique paID code. [WebsiteURL]/paid/[PaID] Once paid any workflows you have setup or payment receipt emails or other automated emails will flow automatically. To enable this go to Admin Settings > Payment Gateway > PaID. A highly effective way for large numbers of members to pay, without having to login, reset passwords and pass 2FA.

Mition has a built in Admin function that will go through each member with no Stripe Customer ID and look in the currently connected Stripe account to match the email address to the user in Stripe. If found it will add the Stripe Customer Id to that user account. The function (once logged on as an Administrator) can be triggered via the URL [currentUrl]/api/Migration/BulkMatchStripeAccounts (Where currentUrl is your existing website domain). If this is an existing Stripe Account this step is important as Stripe wont let you have two customers with the same email address, this step matches email addresses to users between your Mition portal and Stripe and adds the StripeCustomerID to the users file for you. This also means if a user has a credit card on file in Stripe, this is now usable in your Mition portal for this client. Being PCI compliant, no staff member can see any credit card information in full. The Stripe Customer ID allows your Mition portal to tell Stripe who to charge and which account.

The following feature allows our customers to add additional charges to their customers/members in the event they elect to pass on the costs to their customers/members for stripe transactions.

Overview: To accommodate the differing Stripe fees for domestic (1.70% + A$0.30) and international (3.5% + A$0.30) credit card transactions, Mition has implemented the ability to create a flat processing surcharge (e.g. 2.5%) GST inclusive on all Stripe transactions. This solution allows our customers to pass on these costs to users while maintaining a streamlined checkout experience.

The fee charged to the customer is not a match 1:1 of the actual Stripe Fee, this feature is designed to cover the majority of the stripe fee. See challenges addressed below for why.

Challenges Addressed:

- Stripe does not disclose the exact card fee before charging.

- PCI compliance prevents access to the complete card number for origin detection.

- Additional charges would incur further Stripe fees.

- User experience would be complicated by requiring card information entry twice.

- GST implications on invoice totals further complicate fee structures.

Solution Benefits:

- A uniform fee (e.g. 2.5%) simplifies calculations without conditional logic based on card origin.

- Users pay only once, avoiding follow-up billing or re-entry of card details.

Implementation Steps:

- Adjustable Processing Fee: The processing fee e.g. 2.5% can be adjusted in Admin Settings.

- Payment Screen Notification: Add a disclaimer on the payment screen stating "+2.5% online processing transaction fee."

- Fee Calculation: Calculate the processing fee (2.5% of the transaction subtotal) and add it to the base amount before creating the Payment Intent in Stripe.

- Invoice Display: The credit card processing fee will be displayed on the invoice as a line item labeled “Credit Card Fee.”

- General Ledger Code Setup: Specify the required General Ledger Code for the fee within Admin Settings. If GST is applicable, the system will adjust the Fee/GST amount in the invoice for accurate accounting, the customer will be charged the % and whether the GL Code has GST or not will change the line item to reflect the amount and the GST. If the GL Code for the fee has GST Excluded, the entire fee amount will be in Amount. If the GL Code has GST to be added, the GST for the FEE is calculated and the FEE is split on the Line item between the Amount and GST Amount field (so the total either way is the % charged). This prevents additional GST fee from being added to the customer.

- Refund Process: When refunding tickets, retain the transaction fee if refunding partial amounts. This will ensure the invoiced amount reflects accurate values, marking it as paid accordingly.

- Application Across Modules: This fee will apply to all modules (Events, Subscriptions, and manually created invoices) only when paying via credit card.

- Download Invoice Behavior: Hide credit card fees when users download invoices before payment to prevent confusion regarding payment methods.

- Adjustments by Staff: Staff can manually delete or adjust the credit card fee from an invoice if it is not paid, allowing for alternative payment methods.

Setup Instructions for Administrators:

To implement this feature, Mition Global Administrators need to:

- Update the percentage in Admin Settings > Payment Gateway > Stripe Fee.

- Select the appropriate GLCode ItemID in Admin Settings > Payment Gateway > Stripe Fee GLCode.

For assistance with communication regarding this update to existing members, please contact your Mition team.

Example: Stripe Credit Card Fee on Charging (Pricing correct as at July 2025)

1. Details:

- Transaction Amount (including GST): A$99.00

- Credit Card Processing Fee Rate: 2.5% (GST inclusive)

- GL Code for Credit Card Fee including GST: 10%

- Stripe Fee Rate: 1.70% + A$0.30

a) Without Credit Card Oncharging

- Calculate Stripe Fees:

Fee Amount: [ (1.70% \times A$99.00) + A$0.30 ]Fee = [ (0.017 \times 99.00) + 0.30 = A$1.683 + A$0.30 = A$1.983 ]

- Amount Received After Stripe Fee:Final Amount Transferred:

[ A$99.00 - A$1.983 = A$97.017 ]

Summary:

- Transaction Amount: A$99.00

- Stripe Fee: A$1.983

- Final Amount Transferred: A$97.017

b) With Credit Card Oncharging

- Calculate Credit Card Fee (2.5% GST inclusive):Credit Card Fee Amount: [ 2.5% \times A$99.00 = A$2.475 ]

- Total Charge to User (Transaction Amount + Credit Card Fee):Total Charge:

[ A$99.00 + A$2.475 = A$101.475 ]

- Calculate Stripe Fees on Total Charge:

Stripe Fee on Total Charge: [ (1.70% \times A$101.475) + A$0.30 ]Fee = [ (0.017 \times 101.475) + A$0.30 = A$1.724075 + A$0.30 = A$2.024075 ]

- Amount Received After Stripe Fee:Final Amount Transferred:

[ A$101.475 - A$2.024075 = A$99.450925 ]

Summary:

- Transaction Amount: A$99.00

- Credit Card Fee Added: A$2.475

- Total Charge to User: A$101.475

- Stripe Fee: A$2.024075

- Final Amount Transferred: A$99.450925

c) Comparison with Stripe Actual Fee

Final Amount Transferred without Credit Card Oncharging:

A$97.017

With Credit Card Oncharging

A$99.450925

Conclusion:

By implementing the credit card fee oncharging, the final amount received by your organisation increases to A$99.450925, compared to A$97.017 without the fee oncharging.

Note: The 2.5% fee is adjustable and each organisation can determine the rate to use to provide a fair basis for their members. In this case the full Stripe Fee was no recouped, but the majority of the fee was able to be passed on.